How To Calculate The Loan Amount For a DSCR Mortgage

In the world of real estate investment, securing the right financing can make all the difference in the profitability and success of your ventures. This is where Debt Service Coverage Ratio (DSCR) loans come into play, offering a specialized lending solution tailored for rental and investment properties.

Unlike traditional mortgage loans, which primarily focus on the borrower's personal financial history, DSCR loans evaluate the potential income of the property itself. Understanding how to calculate the loan amount using DSCR is crucial for investors looking to maximize their investment's financial leverage. It allows investors to gauge how much they can borrow based on the property's ability to generate income, ensuring that the loan supports their investment goals without overburdening them with unsustainable debt.

This introduction to DSCR loans will guide you through the essentials of calculating your loan amount, empowering you to make informed decisions in securing loans for rental and investment properties.

What is a DSCR Loan?

A Debt Service Coverage Ratio (DSCR) loan is a type of financing specifically designed for real estate investors, focusing on the income-generating potential of the property rather than the personal financial status of the borrower.

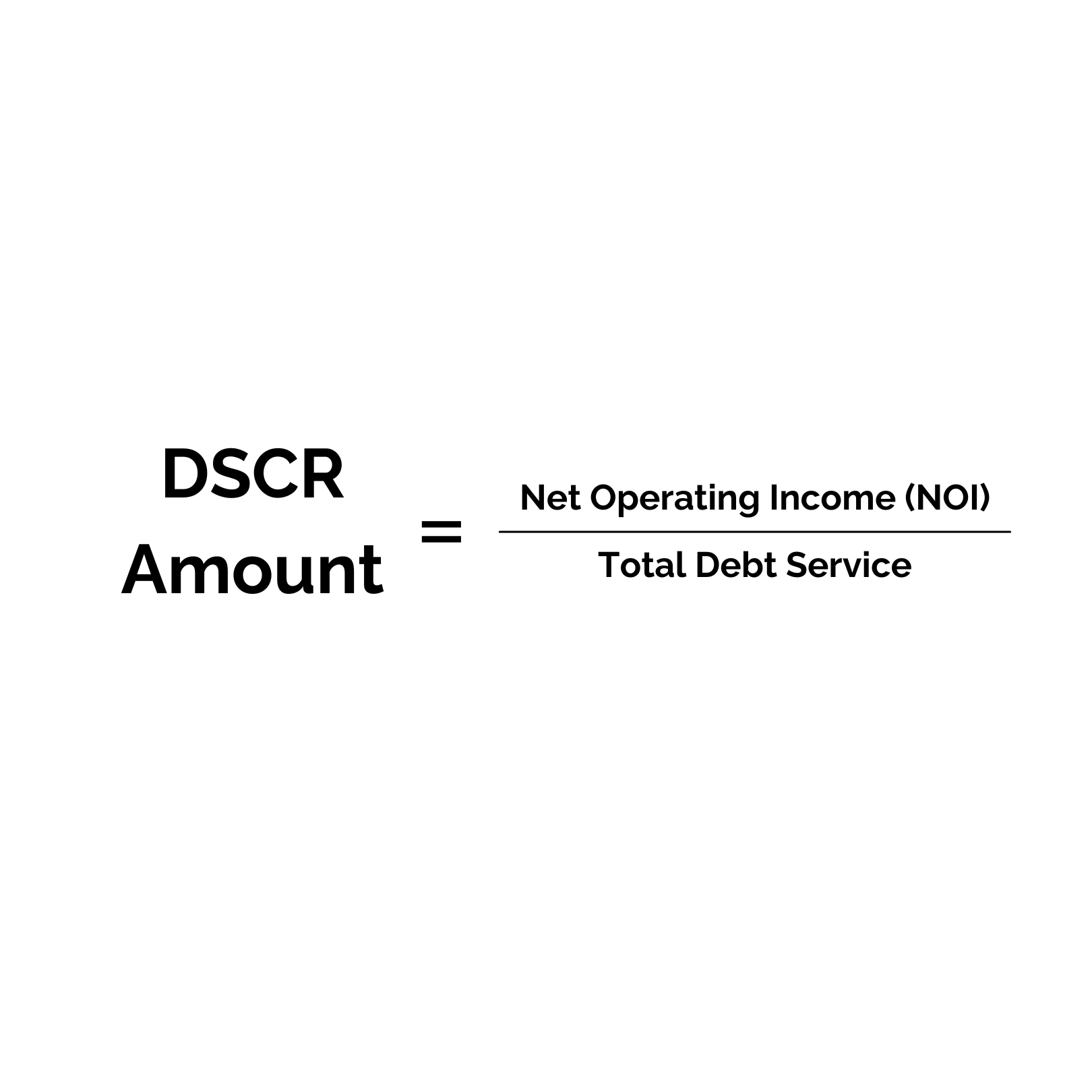

The DSCR is a financial metric used by lenders to determine the ability of a property to generate enough income to cover its debt obligations. It is calculated by dividing the property's Net Operating Income (NOI) by its annual debt service, including principal, interest, taxes, insurance, and any other mandatory expenses.

A ratio of 1 or above is typically considered satisfactory, indicating that the property generates sufficient income to cover its debt service.

DSCR loans stand apart from traditional mortgage loans in several key ways. Traditional mortgages primarily assess a borrower's creditworthiness, employment history, and personal income to determine loan eligibility and terms.

In contrast, DSCR loans evaluate the financial performance of the property itself, making them an ideal option for rental and investment properties that may not otherwise qualify under traditional lending criteria.

This focus on the property's income potential allows investors to leverage their assets more effectively, enabling the acquisition or refinancing of properties based on their ability to generate rental income. It offers a flexible financing solution for investors looking to expand their portfolios, especially those who might be self-employed or have irregular income streams but own income-producing properties.

Furthermore, DSCR loans can accommodate a variety of investment strategies, from single-family rentals to multi-unit dwellings, offering a scalable financing option that grows with an investor's portfolio.

By prioritizing the income-producing capability of the property, DSCR loans provide a pathway for investors to secure funding based on the merits of their investment, rather than their personal financial picture, facilitating a broader range of investment opportunities in the real estate market.

Why DSCR Loans Are So Powerful For Investment Properties

The Debt Service Coverage Ratio serves as a critical gauge in the realm of investment property financing, offering a quantifiable measure of a rental property's financial health and viability.

This metric is pivotal for both lenders and investors, as it quantitatively assesses a property's ability to generate enough rental income to cover its debt obligations, thereby ensuring the sustainability of the investment over time.

Lenders rely on DSCR to evaluate loan applications for investment properties because it provides a clear, objective measure of the property's potential profitability and risk level.

A property with a DSCR of less than 1 indicates that its income is insufficient to cover its debt service, signaling a higher risk for lenders.

Conversely, properties that maintain a DSCR greater than 1 demonstrate a buffer of income over and above the debt service, suggesting a lower risk and a more attractive loan candidate.

This ratio helps lenders mitigate risk by ensuring that the loan amount is proportionate to the income-generating capability of the property, rather than solely based on the borrower's personal financial situation.

For real estate investors, understanding and optimizing the DSCR of their potential investments is crucial. It not only affects their ability to secure financing but also impacts the investment's long-term sustainability and growth potential.

A favorable DSCR can unlock more favorable loan terms, lower interest rates, and increased borrowing capacity, directly influencing the scalability of an investor's portfolio.

Moreover, the DSCR criterion encourages investors to conduct thorough due diligence on their prospective investments, including detailed market analysis, realistic income projections, and efficient property management strategies.

This comprehensive approach to investment evaluation promotes more informed decision-making and strategic financial planning, ultimately leading to more successful and profitable investment outcomes.

What Components Make Up a DSCR Loan Calculation

The Debt Service Coverage Ratio (DSCR) is calculated using a formula that juxtaposes a property's Net Operating Income (NOI) against its debt service obligations over a given period, typically a year. This calculation is fundamental in real estate financing, offering lenders and investors a clear picture of a property's financial health. The formula for DSCR is:

Net Operating Income (NOI): is the total income a property generates from its operations, minus the operating expenses. NOI is crucial in the DSCR calculation as it reflects the property's profitability before financing and tax expenses.

It includes all revenue from the property, such as rent, parking fees, and service charges, minus operational expenses required to maintain and manage the property. These expenses include property management fees, maintenance costs, property taxes, insurance, and utilities not covered by tenants.

For example, if a rental property generates $120,000 annually in rental income and incurs $40,000 in operating expenses, the NOI would be $80,000.

Total Debt Service: refers to the annual cost of repaying both the principal and interest on borrowed funds. This includes mortgage payments or any other loan associated with the property.

To illustrate, let's assume the total debt service for the property in the example above is $50,000 annually. The DSCR calculation would be:

This result indicates that the property generates 1.6 times the amount of income needed to cover its annual debt service, signaling a healthy financial state and a lower risk for lenders.

Understanding the components of the DSCR calculation allows investors to evaluate potential investments more accurately and manage their properties to meet or exceed financial benchmarks, ensuring their investments remain viable and attractive to lenders.

How to Calculate A Loan Amount Using DSCR Loan Guidelines

Calculating the maximum loan amount using the Debt Service Coverage Ratio (DSCR) requires a clear understanding of the property's income potential and the desired DSCR threshold set by lenders. Typically, lenders look for a DSCR of 1.25 or higher, indicating the property generates sufficient income to cover its debt obligations by a comfortable margin. Here's a step-by-step guide to calculating the loan amount based on a desired DSCR threshold:

Step 1: Determine Net Operating Income (NOI)

Calculate the NOI by subtracting all operational expenses from the total income generated by the property. For instance, if a property brings in $100,000 in rent annually and has $30,000 in expenses, the NOI is $70,000.

Step 2: Establish the Desired DSCR Threshold

Decide on the DSCR threshold required by the lender or that you aim to achieve. For this example, let's use a common threshold of 1.25.

Step 3: Calculate Annual Debt Service

Using the desired DSCR threshold, rearrange the DSCR formula to calculate the maximum allowable annual debt service. The formula becomes:

Annual Debt Service = NOI / DSCR Threshold

For an NOI of $70,000 and a DSCR threshold of 1.25:

Annual Debt Service} = $70,000 / 1.25 = $56,000

Step 4: Determine Maximum Loan Amount

Using the annual debt service, work with a lender or use a loan calculator to determine the maximum loan amount, factoring in the interest rate and loan term. For instance, if the calculated annual debt service is $56,000, and the lender offers a 4% interest rate on a 20-year loan, the maximum loan amount can be calculated using a mortgage calculator or financial software.

Example Scenario:

If the property's rental income increases to $120,000 with the same expenses, the NOI becomes $90,000. With the same DSCR threshold:

Annual Debt Service} = $90,000/ 1.25 = $72,000

This increase in NOI and subsequent annual debt service allows for a larger loan amount under the same terms, demonstrating how improvements in property income directly impact borrowing capacity.

By following these steps, investors can precisely gauge how much they can borrow based on the income-producing capabilities of their investment property, ensuring they maintain a healthy balance between income and debt service.

Factors that can influence your DSCR Loan

The calculation and qualification for a Debt Service Coverage Ratio (DSCR) loan are influenced by several key factors. Understanding these elements can help investors strategically improve their property’s DSCR, thereby qualifying for larger loan amounts. Below, we delve into how interest rates, loan terms, and property types impact DSCR calculations and offer tips for enhancement.

Interest Rates

Impact: Interest rates directly affect the total debt service of a loan. Higher interest rates increase the debt service payments, potentially lowering the DSCR. Conversely, lower interest rates reduce the debt service burden, improving the DSCR.

Tips for Improvement: Securing the best possible interest rate is crucial. This can be achieved by improving credit scores, shopping around for lenders offering competitive rates, and negotiating loan terms. Sometimes, opting for a slightly higher rate with a longer amortization period can improve DSCR by reducing monthly payments.

Loan Terms

Impact: The terms of the loan, including the amortization period and the loan structure (e.g., fixed vs. variable interest), significantly influence the DSCR. Longer amortization periods result in lower monthly payments, improving DSCR, while shorter periods can have the opposite effect.

Tips for Improvement: Investors might consider longer amortization periods to enhance their DSCR. It’s also beneficial to analyze how different loan structures affect the DSCR to choose the most advantageous option.

Property Types

Impact: The type of property being financed plays a crucial role in the DSCR calculation. Properties with stable and predictable income streams, like multifamily units or long-term commercial leases, may achieve a higher DSCR. In contrast, properties with higher operational costs or more volatile income, such as vacation rentals, might face challenges in maintaining a favorable DSCR.

Tips for Improvement: Focus on properties with reliable income potential and consider ways to reduce operational expenses. Implementing efficiency improvements, renegotiating service contracts, and optimizing rental strategies can increase NOI, thereby improving the DSCR.

Strategies for Boosting Your DSCR Loan Amount

Operational Efficiency: Reducing unnecessary operational expenses boosts NOI, directly improving DSCR. Conduct regular reviews of property expenses to identify cost-saving opportunities.

Revenue Maximization: Explore avenues to increase income through property upgrades, adding amenities that attract higher-paying tenants, or optimizing rental prices based on market research.

Refinancing Existing Debts: If feasible, refinance existing high-interest debts to lower interest rates or extend loan terms, reducing monthly debt service obligations and improving DSCR.

Selective Financing: For new acquisitions, select properties that not only fit your investment strategy but also exhibit characteristics conducive to a favorable DSCR. Properties in locations with strong rental demand and growth potential typically offer better income stability.

By focusing on these factors and employing strategies to improve operational efficiency and revenue, investors can significantly influence their property’s DSCR. This not only enhances the chances of loan approval but also positions the investment for greater financial health and potential for expansion.

How To Apply For A DSCR Loan

The application process for a Debt Service Coverage Ratio (DSCR) loan involves meticulous preparation and an understanding of the specific documentation and information lenders require. Here’s a comprehensive overview to guide potential homebuyers through this process, along with strategic tips to avoid common pitfalls.

Required Documentation and Information

Financial Statements: Lenders will request the property’s financial statements, including profit and loss statements, to evaluate the Net Operating Income (NOI).

Property Appraisal: An appraisal report is necessary to determine the current market value of the property, crucial for calculating the loan-to-value ratio.

Rental Income Proof: Documents such as lease agreements provide proof of the property’s rental income, essential for assessing the DSCR.

Personal Financial Documents: Although the focus is on the property’s income, lenders may still require your personal financial information, including tax returns, credit reports, and bank statements, to gauge overall financial stability.

Business Plan: For investment properties, a detailed business plan outlining management, maintenance, and strategies for income maximization can strengthen your application.

Tips and Common Pitfalls

Ensure Accuracy: Inaccurate or inflated income and expense figures can lead to complications. Provide precise, verifiable financial information.

Understand the Property’s Financials: Familiarity with the property’s financial performance is crucial. Misunderstanding the NOI or the impact of expenses can negatively affect your DSCR calculation.

Anticipate Lender Concerns: Be prepared to address potential lender concerns, such as vacancies or irregular income patterns, by demonstrating how you plan to manage these risks.

Seek Professional Advice: Consulting with a financial advisor or mortgage broker experienced in DSCR loans can provide valuable insights and help avoid common pitfalls, such as choosing the wrong loan product or misunderstanding the terms.

By thoroughly preparing and understanding the requirements and potential challenges of applying for a DSCR loan, potential homebuyers can navigate the process more smoothly, increasing their chances of a successful application. Remember, the key is to present a compelling, financially sound case that reassures lenders of your investment’s stability and profitability.

Maximizing Your Investment with the Right DSCR Loan

Choosing the right Debt Service Coverage Ratio (DSCR) loan is pivotal in aligning with your investment goals and ensuring the long-term success of your real estate ventures. The key to maximizing your investment lies not just in selecting a loan but in partnering with the right financial experts. Working with experienced lenders or loan officers who specialize in rental and investment property loans can make a significant difference.

These professionals possess a deep understanding of the market dynamics and can provide tailored advice, ensuring that your loan aligns perfectly with your financial objectives.

An experienced loan officer can navigate the complexities of DSCR loans, helping you to understand the nuances of various loan products and guiding you towards the best options based on your property's income potential and your personal financial situation. They can also assist in strategizing the loan structure to enhance your investment's profitability and growth potential.

In conclusion, while the right DSCR loan can provide the financial backbone for your investment property, the expertise and guidance of a seasoned loan officer are invaluable.

If you're looking to leverage a DSCR loan for your next investment, consider reaching out to our loan officer. Their expertise in crafting financial solutions that cater to the unique needs of real estate investors can help you unlock the full potential of your investment, ensuring prosperity and success in your real estate endeavors.